Browse our news section to find out more about what we’re doing in the financial wellbeing space.

We also share updates on any finance industry news as well as personal money matters.

You can also follow us on LinkedIn.

- All

- Blog

- Community News

- News

Lifetime workplace wellbeing event proves a smash hit!

As a passionate advocate of wellbeing, Lifetime is always looking at ways of ensuring that our people, and all those organisations we partner with, feel happy and valued within the workplace. On Wednesday afternoon we put our work commitments to one side for a few hours in order to enjoy a Lifetime Workplace Wellbeing and […]

Pros and cons of the 95% mortgage deal

Several major mortgage lenders are taking part in a Government guarantee scheme, where house-hunting people can gain access to 95% mortgages. The scheme, which is due to run until mid-2025, has been designed to increase the number of deals that are available for want-to-be homeowners with a low deposit or limited equity. However, these should […]

A quarter of UK population will soon be aged over 65 – but is their later life mapped out?

Soon, 25% of the UK population will be aged over age 65. Many of those people will live another 20 or 30 years, so it is important that help, guidance and financial advice is easily accessible so they can navigate the complex world of pensions, tax, income and legacy planning with clarity and confidence. This […]

Don’t lose sight of your staff’s wellbeing

During the current cost-of-living crisis employers are being urged to not lose sight of the wellbeing of their workforce. Indeed, the importance of an employee’s financial wellbeing cannot be underestimated. At Lifetime we know just how vital it is, and we have the statistics and benchmarking to prove it. For example: Over 90% of employers […]

Ten things to think about and act upon before end of tax year

The current tax year ends on Friday (April 5th). Here are 10 things that are worth thinking about – and acting upon. Have you maximised your pension contributions? Have you considered making a pension contribution for a child or grandchild? Have you used your annual ISA allowance? £20,000 per adult. Could you use your annual […]

This Easter make sure you hatch a plan for your own tidy nest egg!

Happy Easter everyone! While this weekend the children and grandchildren might well be busy hunting for colourful eggs and devouring chocolate Easter bunnies, it’s also an ideal time to think about getting your finances in order and hatching a plan to ensure your own tidy nest egg for the future. Of course, saving is a […]

Protect the people you love…

It is vitally important to have the knowledge and ability to make good decisions that will protect your family and loved ones if there is an unexpected/untimely death, illness or accident. For example, if you or your partner were unable to work would your household expenditure be covered? Lifetime’s specialists work with you to answer […]

Debt can affect how we feel, think and act

Debt can happen to anyone. It is how we deal with it that can have a major impact on our lives. Owing money can be stressful. It can make us anxious and affect our mental wellbeing, as well as our financial wellbeing. This year’s Debt Awareness Week runs from 18th to 24th March – and we […]

It is important to acknowledge how you feel about money

Sometimes we may feel angry or jealous that other people spend money on things we want but can’t afford. When that feeling occurs why not try and consider these points: Try and avoid making purchases when you’re angry or jealous, especially if it simply to try and impress others Listen to your friends or family. […]

How the Spring Budget affects you and your finances

The Chancellor of the Exchequer Jeremy Hunt delivered his Spring Budget to the House of Commons this afternoon (March 6th). Let’s have a quick look at how his decisions may affect you and your finances. As widely anticipated, Mr Hunt’s key announcement was a further 2% cut in National Insurance for working people and the […]

Is employee wellbeing on your agenda? Here’s what could be achieved!

The success of our recent ‘Ways to Wellbeing ‘conference at Winstanley House, Leicester once again emphasised that looking after employees should be right at the top of any organisation’s agenda. Introducing financial wellness programmes in the workplace is a crucial element in supporting stressed employees who are facing money challenges. Here are 10 ways that […]

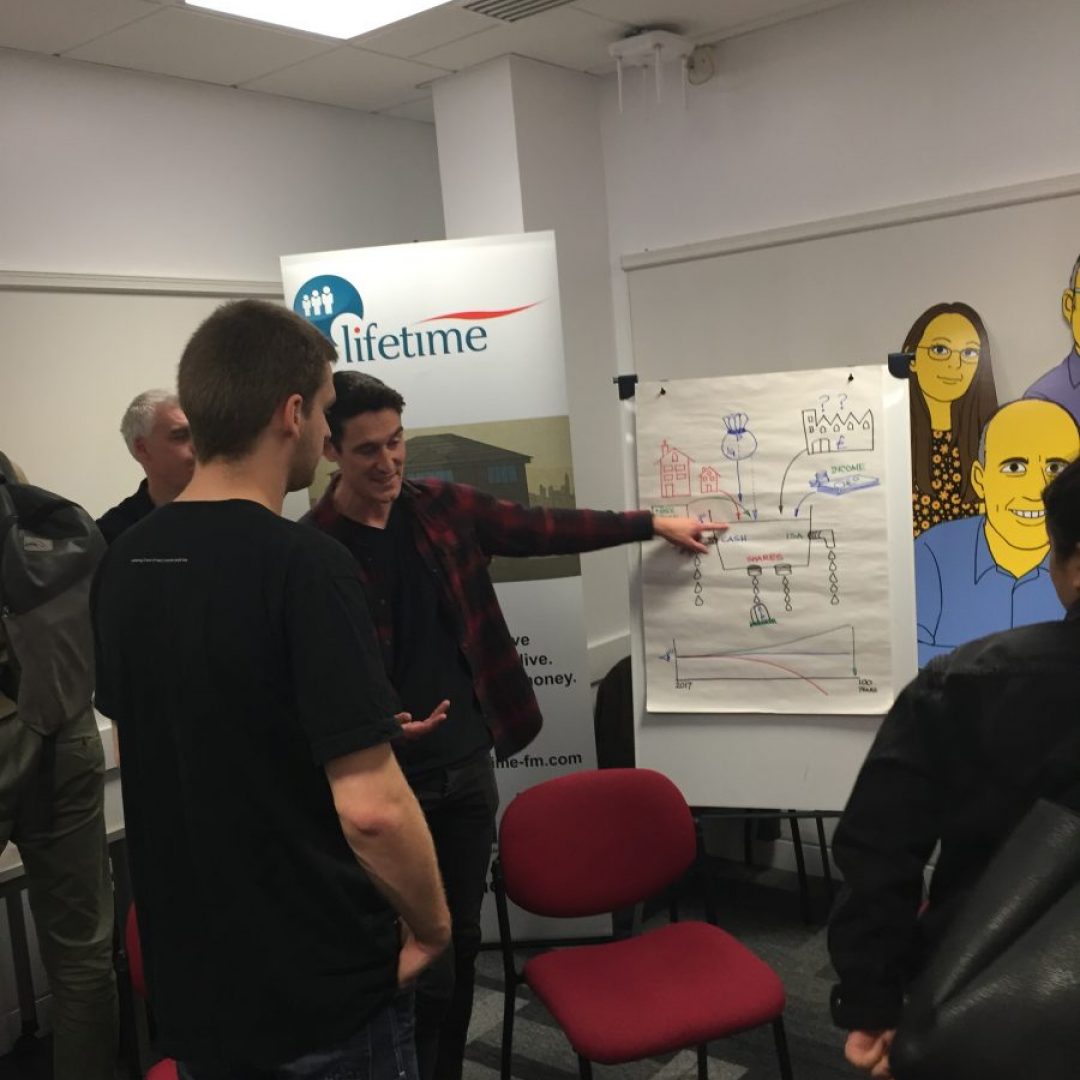

Ways to Wellbeing conference puts workforce at centre of the conversation!

The Lifetime-organised Ways to Wellbeing conference on Wednesday, February 28th proved to be a big hit! The event, at Winstanley House, Leicester, was aimed at enhancing and elevating employee wellbeing and engagement, and showcased relevant and interesting topics from speakers who are experts from the fields of financial wellbeing, mental health and nutrition. Delegates attending […]

April price cap cut to bring some welcome relief to millions of UK households

A bit of good news is coming for millions of UK households this April. The typical annual energy bill will fall 12.3% to the lowest for two years, under the new price cap set by the regulator, Ofgem. The price cap, arranged for April until June, will be £1,690, a drop of £238 a year […]

Financial planning video from Lifetime ‘opened up my eyes’ says worker

Lifetime’s digital coaches help employees, families, couples and individuals get to grips with their personal finances. They play a huge role in promoting the importance of financial education and financial wellbeing – and their efforts can often prove to be life-changing! And as such we just wanted to share this lovely testimonial we’ve had from […]

Estimated income required for retirement continues to rise

The hope is that a pension can provide you with the comfortable retirement you strive for. You don’t want you to get to retirement and not find the joys in life, you want you to get to retirement and live some of your very best years. And yet…according to The Pensions and Lifetime Savings Association […]

Different attitudes between generations when it comes to funding retirement

A third of ‘Gen Z’ – people born in or later than 1996 – believe property will be their main source of wealth in retirement. That’s according to the latest research from according to research from life assurance, pensions and long-terms savings company Standard Life. Their ‘Retirement Voice’ report revealed different attitudes between generations when it […]

Grab the chance to discover important ways to workplace wellbeing

As a seasoned financial wellbeing organisation, Lifetime is always looking at innovative ways of helping employers support their staff. That’s why we are delighted to have organised the ‘Ways to Wellbeing’ conference on February 28. The event brings together a group of experts who will focus on all all the positive strategies you can put […]

Family finance tips for health, happiness and harmony!

Making time or even plucking up the courage to have a conversation about money and long-term goals can often be difficult, and most family units face serious challenges when it comes to dealing with money. Numerous research studies have shown that finance is among the top reasons why couples argue. Disagreements occur over how to […]

Press coverage for what’s App-enning at Lifetime!

Delivering a holistic financial wellbeing service to as many people as possible. That’s our mission. We are passionate about it. Having the necessary financial education can make such a difference! So we were delighted (and proud) to discover that The Yorkshire Post were keen to do a detailed report on what we are doing, that was published […]

Mortgage lenders begin 2024 by cutting rates but millions of UK households still face rise in repayments

The average rate on a two-year fixed mortgage has fallen to its lowest level for nearly seven months, as lenders compete for custom. Financial information service Moneyfacts said the average rate had fallen from 5.92% to 5.87% in a day. Major lenders, such as the Halifax and HSBC, have begun 2024 with rate cuts, in […]

Make your financial health a priority in 2024!

The first month of a new year is a great time to make a real effort to look after your own wellbeing – and that includes your financial health! You won’t be alone if you have made a few resolutions for the next 12 months or so. Lots of people will be in that frame […]

Here’s wishing you a very happy Christmas – and a wonderful New Year!

Today is our last day before breaking up for the festive season, and all of us here at Lifetime would like to wish everyone a very Happy Christmas – and a wonderful New Year! For many it has been another tough year, with a number of things playing havoc with our emotional and financial wellbeing. […]

Have you got Christmas covered?

The festive season is no longer on the horizon, it is almost here! It is a time of excitement, for young and old. Yet according to a new study by professional services organisation KPMG, over a third of UK consumers are planning to cut back on their Christmas gift spending. That is being put down […]

Financial wellbeing goes hand in hand with stability

Financial wellbeing goes hand in hand with stability. And both are crucial when it comes to the workplace. They go a long, long way to helping people do their best work. They bring peace of mind, can boost confidence, and can propel productivity. Good leadership – and the determination and clear sightedness to put an […]

The Government’s Autumn Statement – what does it all mean?

The Chancellor of the Exchequer Jeremy Hunt has claimed that the government’s economic plan ‘is working’, but that the work is by no means done. Mr Hunt delivered his Autumn Statement to the House of Commons on Thursday afternoon (November 22) and appeared eager to tell his fellow MPs that the tide was turning in […]

Lifetime shortlisted for Best Financial Wellbeing Service Provider

Lifetime has been shortlisted for another wellbeing award! The organisation is thrilled to be nominated for Best Financial Wellbeing Initiative 2023-24 in the Great British Workplace Wellbeing Awards. Employee engagement and wellness are rightly taking centre stage in the business world – and these prestigious awards, which have a number of different categories, recognises the […]

Talking with a finance professional can help boost your wellbeing and happiness

November 6th 2023 is the start of this year’s #talkmoneyweek – and we want to highlight the importance of talking with a professional about your finances, so that you can be in control of your finances, and not the other way around! Financial wellbeing is essential for a happy and fulfilling future. It gives you […]

The importance of alleviating stress in the workplace

Today is National Stress Awareness Day! And we’d like to highlight the importance of helping alleviate stress in the workplace. Even in the most upbeat company cultures and environments, staff can still get stressed out about their personal finances. Don’t underestimate the impact of a compassionate approach! Learn how an innovative wellbeing initiative can address […]

What are your priorities when it comes to your money

Two of the biggest things that financial planning can give you is clarity and understanding. And understanding your needs versus wants is important. The distinction between what you want and what you need is key. It is okay to buy the things you need, but when it comes to things that you only want, then […]

Menopause can often have a negative affect and impact on a person’s financial wellbeing and security

Today is #worldmenopauseday – and we’d like to highlight how the menopause can often have an affect on someone’s finances. Menopause is a natural change in the balance of the body’s hormones that comes with age, but despite the millions of workers affected – indeed roughly 50% of the population – it can be misunderstood […]

Join free webinar and discover ways of unlocking wellbeing in your workplace

Employees who are financially stressed are more likely to experience health problems, mental health issues, and absenteeism. They are also less likely to be focused and motivated at work. This forthcoming webinar by Lifetime is designed to help employers understand the benefits of investing in financial wellness for their employees. In this webinar, you […]

More sick days being taken by UK workers than at any time in last 10 years

UK workers are taking more sick days than at any point in the last 10 years, research by the Chartered Institute for Personnel and Development (CIPD) suggests. Staff took on average 7.8 sick days in the past year, according to the CIPD. That statistic is up from 5.8 days before the Covid-19 pandemic. The CIPD […]

Having a financial plan can change your whole outlook on life

Welcome to World Financial Planning Day 2023! With many parts of the world, including the UK, experiencing economic strain and a seemingly constant battle with the cost of living, it is becoming more and more important to emphasise the positivity and wellbeing a flexible financial plan can bring to someone’s life. World Financial Planning Day […]

Knife-edge decision sees Bank Of England keep interest base rate at 5.25%

The Bank of England today (Thursday, September 21st) chose to leave the UK’s interest rates unchanged at 5.25%. The Bank (BOE) had previously raised rates 14 times in a row, in a battle to bring down inflation. That had led to increases in mortgage payments, but also higher savings rates. It was tipped as being […]

Making the right decisions that will bring protection for your loved ones

It is vitally important to have the knowledge and ability to make good decisions that will protect your family and loved ones if there is an unexpected/untimely death, illness or accident. For example, if you or your partner were unable to work would your household expenditure be covered? Lifetime’s specialists work with you to answer […]

How to bring about a happier, healthier and more financially aware workforce

Even in the most upbeat company cultures and environments, staff can still get stressed out about their personal finances. When employees can’t focus on work due to the financial strain and worry they are under, it is not only they who suffer. Employers pay the price too, particularly when it comes to motivation, concentration and […]

A financial plan; what is it, why it’s important and how can you get one

Finance professionals and experts often talk about having ‘a financial plan’. But just what is it? Why is it so important? And how can you get one? Well, the first thing to point out is that money is an important subject. It often plays a crucial part in how you live your life, now and […]

Rise in money-related health issues

The latest research shows that half of doctors and other health and care professionals are reporting a rise in money-related health issues. And yet the majority of those dedicated health and care professionals feel they are unequipped to have such financial conversations with the patients affected. While they are tremendously talented and highly skilled in […]

Lifetime attend Vivup Benefits Day to promote wellbeing in the workplace

Members of the Lifetime team attended the Vivup Benefits Day in Birmingham on Thursday (August 3rd). Our COO Andy Wealthall, along with colleagues Sarah Kewley and Georgia Ryder, were at the Lifetime stand, talking about the importance of financial wellbeing and education within the workplace. Andy also delivered a presentation explaining how Lifetime’s financial wellbeing […]

Bank of England raises interest base rate by a further 0.25%

The UK’s interest rate has today (Thursday, August 3rd) been raised a further 0.25% by the Bank of England (BOE), to a new level of 5.25%. It is the 14th hike in a row and the last time the base rate was this high was over 15 years ago, back in April 2008. The reason […]

Taking the high road for the people who need us

Taking the high road. As a financial services company, we have always championed the importance of putting customers first. Indeed, our core values are geared towards delivering the very best service we can for the people who ask for our help. We stand by the line: “If it’s not right for the client, then it’s […]

Finding solutions for poor financial wellbeing

It is frightening when you see the damage that can result from poor financial wellbeing. We’ve seen it. That’s why we are passionate about delivering a solution. Wellbeing in the workplace is a hot topic. Employees are seeking help, and inaction is simply not an option anymore. A holistic financial wellbeing programme, established deep into […]

Lifetime shortlisted in three categories for this year’s prestigious Workplace Savings and Benefits Awards

Lifetime is thrilled to have been shortlisted in three categories for this year’s Workplace Savings and Benefits Awards. The accolades, which recognise both employer and provider excellence, attracts many of the best and biggest organisations in the UK, as well as the most innovative, and the whole team at Lifetime are proud to have been […]

There are clear benefits to workplace stability and wellbeing

Financial wellbeing goes hand in hand with stability. And both are crucial when it comes to the workplace. They go a long, long way to helping people do their best work. They bring peace of mind, can boost confidence, and can propel productivity. Employers need to be focused on helping their employees when it comes […]

Unlucky 13 for many UK mortgage holders as interest rates continue to climb

It is unlucky 13 for some! At lunchtime on Thursday (June 22nd) the Bank of England (BoE) raised interest rates for the 13th time in a row. That was expected, but what did come as something of a surprise (and a pretty nasty one for those people on a variable rate mortgage) is that the […]

Protection pay outs reached record high last year – but just what is protection insurance?

The total amount of protection pay outs for both individual and group protection policies hit £6.85bn in 2022, according to the Association of British Insurers (ABI) and industry body Group Risk Development (GRiD). This is a relatively small increase from the previous record £6.8bn of pay outs by protection providers in 2021. Overall, providers paid […]

Energy regulator announces July lowering of price cap

Around 27 million UK households can expect a modest drop in their energy bills from July, after the regulator Ofgem announced a lowering of the price cap. When the change comes into effect this summer people will see their average gas and electricity bills fall from the £2,500 a year level set by the government’s […]

A look at deposit-free mortgages

For those people who are renting and struggling to save a cash deposit for a home, getting a mortgage can often seem like an absolute pipedream. However, the recent reintroduction of deposit-free deals could turn those dreams into reality. Deposit-free mortgages where there is no financial guarantor necessary have become available for the first time […]

New report indicates millions of UK adults are struggling financially

More than 10 million adults in the UK are currently struggling with their bills. People are admitting to purposely eating less, cancelling insurance policies, using their savings to pay for fuel and food, cancelling any memberships they have, such as the gym, and obtaining credit, a study undertaken by the Financial Conduct Authority (FCA) has […]

Clear links between financial health and mental health

Today is the start of #MentalHealthAwarenessWeek2023. Talking about things that trouble you may help. But making people feel comfortable enough to talk is difficult. We fully appreciate that. Especially when the subject matter is deeply personal. However, over the last few years there has been huge progress when it comes to addressing the stigma associated with […]

The pros and cons of buy now pay later schemes

The Financial Conduct Authority (FCA) has consistently warned companies who offer ‘buy now pay later’ schemes that they must regularly warn consumers of the risk of debt. Failure to do so would be ‘misleading’ and at worst be a breach of regulatory rules, according to the FCA. Platforms such as Klarna, Clearpay and Laybuy have […]

Lifetime’s fun-packed, activity-filled wellbeing event goes down a storm!

Lifetime are passionate advocates of wellbeing – and as such we are always looking at ways of ensuring that our people, and all those organisations we partner with, feel happy and valued within the workplace. On Wednesday afternoon we put our work commitments to one side for a few hours in order to enjoy a […]

Experts eager deliver food for thought when it comes to wellbeing at work!

There is an in-person event coming up in a few months time that could well pique your interest, where there will be informative talks delivering plenty of food for thought! Passionate about helping organisations create thriving, vibrant workplaces, a group of experts are coming together to focus on the important topic of wellbeing. The Ways […]

As a financial wellbeing company, how do we help?

Is your life full of big questions? We can help you find the answers. Not only that, but we’ll guide you towards your goals and ambitions too. As a financial wellbeing company, how do we help? Well, not only do we provide support, tools and financial education so that you can have a full understanding […]

Be aware! Stress can play havoc with your emotional and financial wellbeing

Stress Awareness Month has been held every April since 1992. The purpose of having such a month is to raise awareness of the causes and possible cures for such a burden on our mental health. Now, let’s face it, it appears that stress is affecting more and more people. We’ve had to endure a fair […]

An employee’s financial wellbeing cannot be underestimated

During the current cost-of-living crisis employers are being urged to not lose sight of the wellbeing of their workforce. Indeed, the importance of an employee’s financial wellbeing cannot be underestimated. Here at Lifetime we know just how vital it is, and we have the statistics and benchmarking to prove it. For example: 89.15% of employees […]

Being fully aware of the debt you have – and how you are dealing with it – is so important

Debt can happen to anyone. It is how we deal with it that can have a major impact on our lives. Owing money can be stressful. It can make us anxious and affect our mental wellbeing, as well as our financial wellbeing. This year’s Debt Awareness Week runs from Monday, March 20th to Saturday, March […]

The Spring Budget – what does it mean for you and your finances?

Getting people into work, and keeping them there for longer, were central themes in the 2023 Spring Budget delivered by Chancellor of the Exchequer Jeremy Hunt to his fellow MPs in the House of Commons on Wednesday (March 15th). The cost of living also remained high on Mr Hunt’s agenda, with households continuing to feel […]

Colour coordinated Lifetime ladies celebrate International Women’s Day 2023!

A colour coordinated group of Lifetime ladies got together to hold a lunchtime quiz, as they celebrated International Women’s Day 2023. The quiz was won by delighted Client Administration Manager Sheila Lynch. The Lifetime ladies were joined by supportive male colleagues to mark a notable day in the calendar. International Women’s Day is a global […]

Just what is financial wellbeing?

What is financial wellbeing? Well, according to Google, ‘it is about making the most of your money from day to day, dealing with the unexpected, and being on track for a healthy financial future. In short: being financially resilient, confident and empowered.’ But like anything of this nature, there can be many interpretations of financial […]

Lifetime webinar on those ‘tough conversations’

We have a new webinar on the way! We have teamed up with Mark Edmondson and Jo “Happiness” Howarth (she/her, anti-racist) to discuss how workplaces can have those tough conversations. Ranging from mental health, illness and financial hardship, our experts want to discuss how you can explore these topics in the workplace. Also featured will be Lifetime’s Commercial […]

Employees are looking to benefit from financial wellbeing

Employees are looking for help. Inaction is not an option anymore. It is estimated that companies are losing 9-13% of what is spent on payroll, through poor productivity and absenteeism amongst other things. Employers are already faced with quite a few strong headwinds, such as inflation, rising costs, the after-effects of Covid-19 and a challenging […]

Lifetime nominated for Customer Service in Yorkshire Choice Awards – and need your votes!

Lifetime are thrilled to have been nominated for the 2023 Yorkshire Choice Awards. Celebrating notable achievement in the white rose county, the nominations for the awards represent the most inspirational individuals, local organisations and aspiring entrepreneurs who have made a genuine impact. Lifetime has been nominated for the Customer Service Award, in recognition of our […]

Bank of England again raise interest rates while households continue to grapple with cost-of-living crisis

Just as oil and gas giant Shell announce record profits, and UK households continue to struggle amid the harsh reality of a historic cost-of-living crisis, the Bank of England (BOE) has raised interest rates for the 10th time in a row. The BOE also admits that the UK economy will ‘fall slightly’ in 2023 but […]

‘A very useful, high quality and accessible financial wellbeing service that everyone can benefit from’

Financial wellbeing is now recognised as the number one employee workplace benefit in the UK. Perhaps that’s not surprising, given the cost of living crisis and the soaring energy bills that has enveloped the country for the past 12 months or so. It is a crucial workplace offering to have, as employees are conceding that […]

Your financial priorities often comes down to knowing what is truly important to you

Determining your financial priorities comes down to one critical thing – and that is knowing what is truly important to you. Your money is used as a tool to achieve those life goals. It is all about priorities – and getting the right ones in place, and in the right order. Your goals and ambitions […]

Guidance and support is available to help you achieve a better money mindset

It’s January, the month of (late) dark mornings and (early) dark nights! It is also Friday, January 13th, with ‘Blue Monday’ just around the corner! Christmas and all those good vibes already seem a lifetime ago. The wet and miserable weather isn’t helping either, especially if you are feeling the chill and want to put […]

A workplace financial wellbeing service can help employees answer their biggest questions, and face their fears

An employer cannot truly support their employees if they don’t know what help they really need. It is important to spend time ‘taking the temperature’ of your organisation, particularly when it comes to the welfare of your people. In order to fully plan ahead, and have a programme in place that puts employees’ wellbeing at […]

Make this the year of your financial wellbeing!

The first month of a new year is a great time to make a real effort to look after your own wellbeing – and that includes your financial wellbeing! You won’t be alone if you have made a few resolutions for the next 12 months or so. Lots of people will be in that frame […]

Wishing everyone a very Happy Christmas – and a wonderful New Year!

As we count down to the ‘big day’, and hopefully finding out that ‘Santa’s been’, all of us here at Lifetime would like to wish everyone a very Happy Christmas – and a wonderful New Year! It has been a tough year, no doubt about it, with the cost of living crisis playing havoc with […]

The time has come to make financial wellbeing work for everyone

There is no doubt that financial wellbeing is a benefit for employee and employer alike. That’s why we need to push it to the forefront of the conversation. Right now, as UK households grapple with rising costs, such financial insight, guidance and advice has never been more important. There are plenty of reasons why financial […]

“Anyone struggling to make their mortgage payments needs to speak to their existing lender as soon as possible”

Mortgage rates climbed throughout 2022, as the Bank of England put up interest rates in their battle to bring down inflation. Those mortgage rates certainly rocketed skyward following Kwasi Kwarteng’s emergency mini-Budget on September 23rd. However, mortgage experts now say that they have stabilised since Jeremy Hunt’s Autumn Statement on November 17th. Fresh data provided […]

The Government’s Autumn Statement – what does it all mean?

The cost of living is soaring at its fastest rate for 40 years. The latest official figures for the cost of living showed that the annual inflation rate jumped to a 41-year high of 11.1% last month, in large part due to a 90% increase in domestic energy bills and rising food prices. In his […]

Financial wellbeing is a subject that needs to be embraced – for the good of us all

Financial education plays an important role in helping people. Sadly, this isn’t something that we receive in our days at school, and as a result many people enter adulthood with very little knowledge of money matters. They find themselves having to learn as they go. That may be okay for some people, but not the […]

Lifetime Employee Survey discovers what money issues your workforce is worrying about

As part of Lifetime’s ongoing efforts to get employees actively engaged with their finances (getting them to talk about their money and fully understand their financial situation), we produce an ‘Employee Survey’. It is used to ‘take the temperature’ of a workforce – and discover just what is on their minds when it comes to […]

Talking about your money can bring big benefits – and lead to financial wellbeing!

This week is…..#TalkMoneyWeek! It is a week that has been designed to increase awareness about the benefits of talking about money. It aims to try and increase people’s sense of financial wellbeing by encouraging them to open up about their personal finances – from pocket money through to pensions. It is so, so important to […]

Things we could do to ease stress – including seeking financial guidance!

Today is National Stress Awareness Day (held every year on the first Wednesday in November). Now, let’s face it, we have all had our fair share of stress days in 2022, what with the cost of living crisis and soaring energy and fuel bills. In these turbulent times, many companies and individuals are either wrestling […]

A pension can play such an important role in your life

This week is #PensionAwarenessWeek. Here at Lifetime we heartily agree it is a subject that needs raising awareness of! Pensions can be a complex subject and we understand the importance a pension can play in someone’s life. Do you know what sort of pension you have? Do you know where your pension is situated? Do you […]

Lifetime lands county crown as most customer-focused financial advisory firm

Lifetime has landed a top award for its customer service. The company has been named the Most Customer-Focused Financial Advisory Firm – South Yorkshire in the Northern Enterprise Awards 2022. The awards programme, run by hosted by SME News, celebrates organisations who work tirelessly to make financial services and advice a positive benefit to as […]

Taking control of your retirement dreams

Every month, more than 10 million people in the UK attempt to squirrel away some money towards their retirement. Yet how many of us are confident that what we are saving is enough? Will there be sufficient money to retire when we want – and live how we want in later life? Surprisingly few people […]

Why choose Lifetime as a financial wellbeing partner for your organisation?

Why choose Lifetime as a financial wellbeing partner for your organisation? Well…. We are specialists in workplace financial education, and have spent years answering the most important questions that employees have. We are passionate about bringing financial freedom and financial health to as many people as possible. Lifetime works closely with employers to deliver tailored […]

Spending time to map out your finances is crucial ahead of any mortgage move

Spending time to map out your finances is a very worthwhile exercise ahead of any plans to acquire a mortgage. It is also advisable to seek out a reputable mortgage broker who can help steer you through to the right outcome. Increases in the Bank of England’s base rate don’t immediately translate into higher rates […]

‘I feel the work Lifetime does is absolutely vital in the current financial climate’

Video and Animation Assistant Rowan Wolowacz has been with Lifetime for just over a month. How’s she finding it? Well…. “It’s wonderful to go to work each day and learn something new,” she says. “I’ve thrown myself in at the deep end surrounded by this incredible level of expertise and empathy. I feel more empowered […]

Your mental heath can also be affected by your financial health

Today is World Mental Health Day. The theme for this year, set by the World Federation for Mental Health, is ‘Make mental health and wellbeing for all a global priority’. And we want to play our part in highlighting it! Your mental health is so, so important. It can affect how we feel, think and […]

Financial education must come with answers to the big questions!

When it comes to financial education, there is lots of stuff out there that can be absorbed, consumed, assimilated, devoured. But people don’t want just more information to drown in! When a consumer looks for something specific on Google, or other search engines, they are not just after reams and reams of data on that […]

Lifetime to deliver free financial wellbeing webinar

Lifetime are hosting a new webinar that is completely FREE for all attendees. The webinar focuses on financial wellbeing, specifically in the workplace, and how it affects both employees and employers. The webinar, which takes place on Thursday, October 6th at 10am, is hosted by Lifetime Commercial Development Director Andy Wealthall (pictured below) and will […]

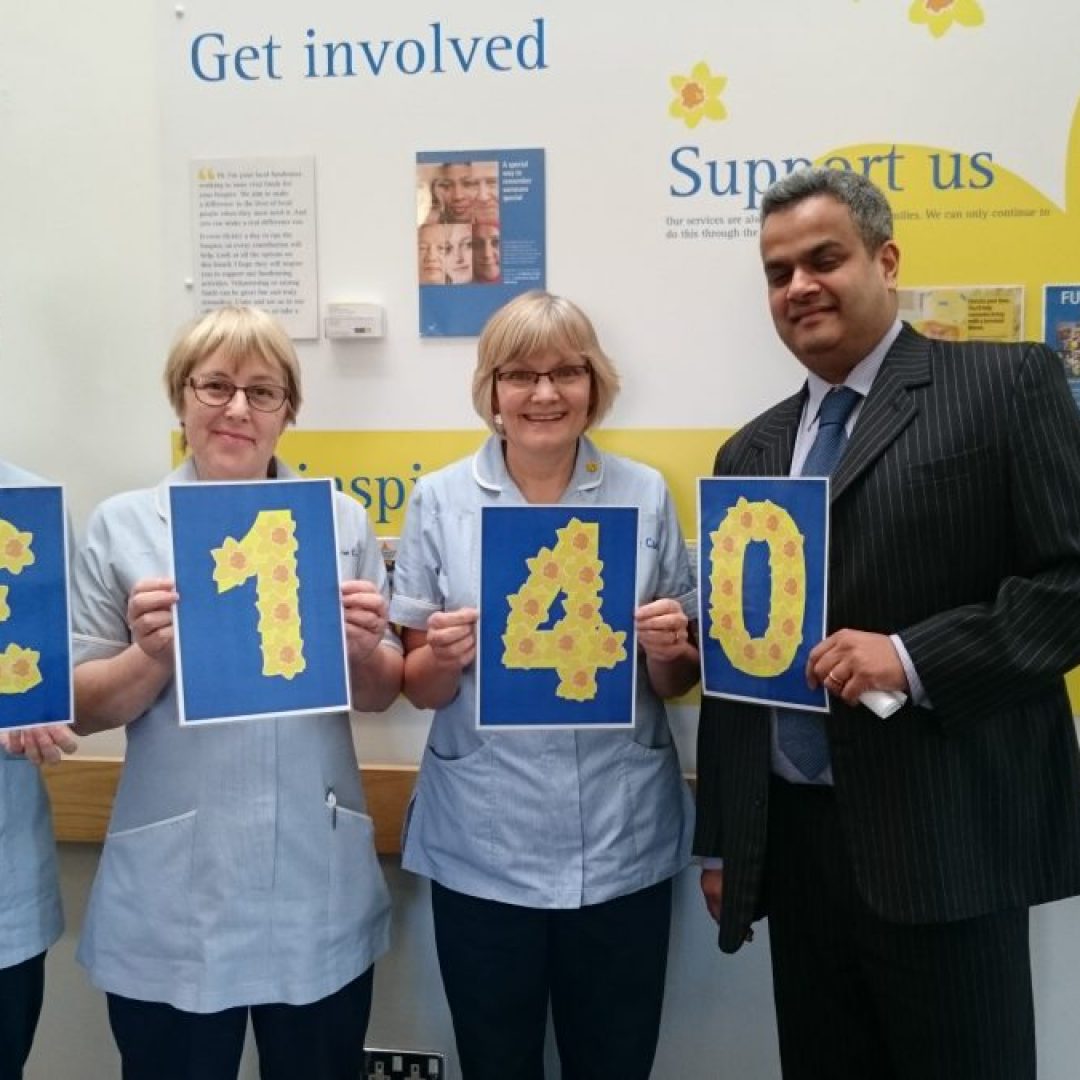

Lifetime announce partnership with Alzheimer’s Research UK on World Alzheimer’s Day

To mark World Alzheimer’s Day (21 September), we have joined forces with the UK’s leading dementia research charity, Alzheimer’s Research UK. Our staff voted in favour of the dementia research charity to be their official charity partner, launching on World Alzheimer’s Day. Over the duration of the partnership, we’ve pledged to raise money to support […]

A Will is a key component of your overall financial plan

When most people think of financial planning, they might be under the impression that just concerns investments, pensions or savings. No, no, no! A purpose-built financial plan is made up of many working parts that all fit together seamlessly. Such a plan should put your goals first and foremost. By clearly identifying and prioritising your […]

A financial wellbeing programme can help with staff retention, acquisition and succession planning

Helping employees with financial management can ease the burden on HR professionals, some of whom may not be equipped to answer finance-related questions from staff. Using a financial management expert delivers value for the employee and in turn frees-up HR resources. Recruitment is expensive, especially in the current climate of a talent drought affecting many […]

UK households finding it tough despite government plans for energy price guarantee

The UK is embroiled in a severe cost of living crisis, which has brought the need to have control over your finances into even sharper focus. But just what is a cost of living crisis? Why is it happening right now? And are you concerned how it is impacting on you? Such an event materialises […]

Lifetime specialists on hand to steer you on the best course to enjoy retirement

The usual starting point when it comes to starting a plan for retirement is income and expenditure. However, it can often be difficult for people to envisage what their life will be like in say 10 or more years’ time. That’s why Lifetime has retirement planning professionals who use specialist software to give customers an […]

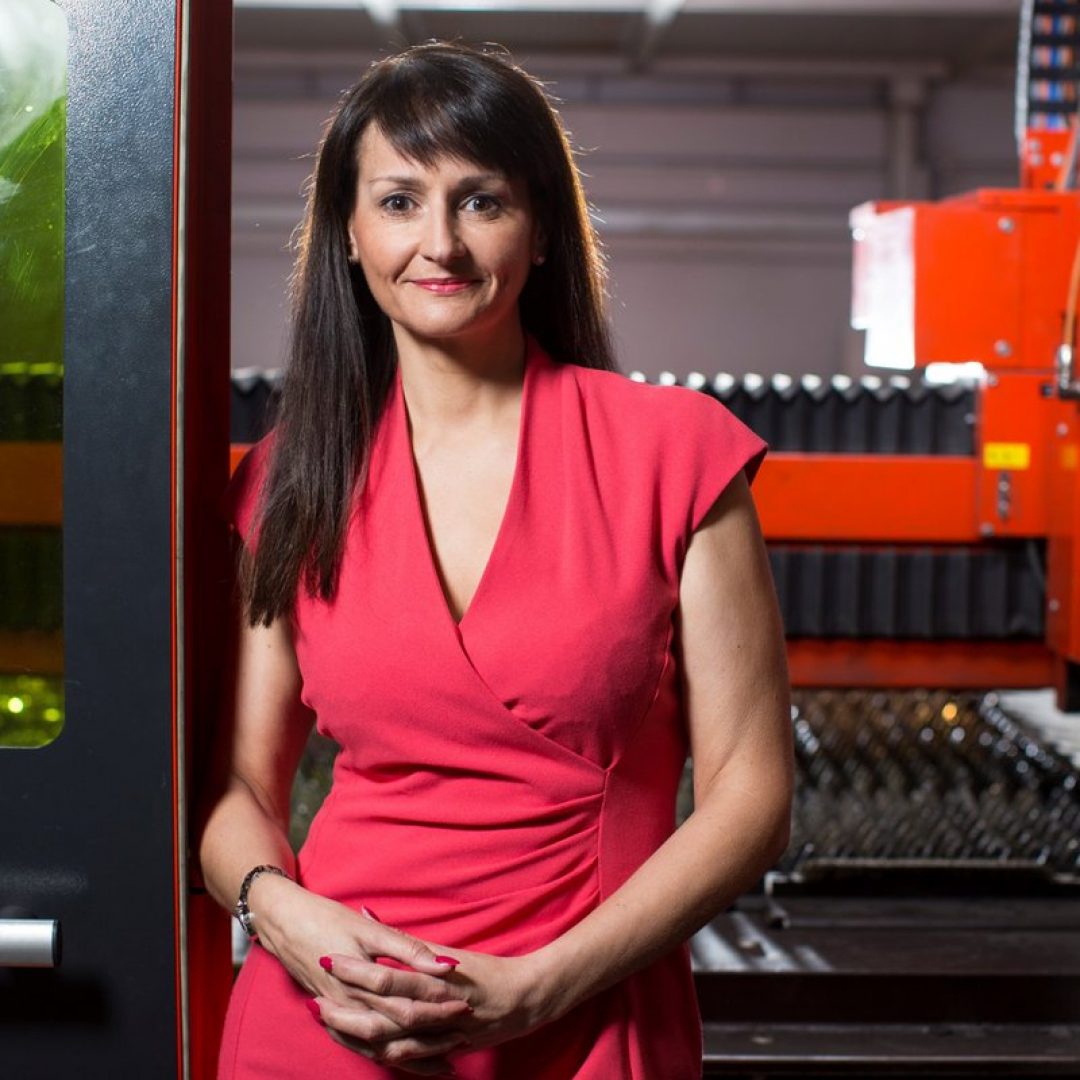

Some wise words from Helen Stocker

During an in-depth chat with Lifetime, Helen Stocker, director of HR Delivered, fittingly delivered some words of wisdom. The conversation had centred on what employers need to start looking at when it comes to employee benefits. Namely financial wellbeing! “Employers often have really good general employee benefits but financial wellbeing benefits can often be overlooked. […]

Six key family finance tips to follow for happiness and harmony!

Making time or even plucking up the courage to have a conversation about money and long-term goals can often be difficult, but working with a Lifetime coach can help you create a comprehensive, flexible plan that can include your immediate family and generations. Most family units face serious challenges when it comes to dealing with […]

Making and sticking to a financial plan that will be beneficial for your growing family

When you find out you’re expecting, your focus is likely to be on getting your home ready for a new baby but you’ll need to make time to put your financial house in order too. A good starting point is to draw up a budget and make a list of all your current incomings and […]

With inflation hitting a 40-year high more and more UK workers are feeling financial squeeze

With the news that the UK’s inflation rate jumped to 10.1 per cent in July – a 40-year high – more and more workers are feeling the financial squeeze. Over half of employees surveyed by Lifetime admitted to feeling stressed or worried about their current financial situation. The national press are tapping in to the […]

Wise words to ponder on the subject of financial wellbeing

Wise words…. During an in-depth chat with Lifetime, Helen Stocker, director of HR Delivered, fittingly delivered some words of wisdom. The conversation had centred on what employers need to start looking at when it comes to employee benefits. Namely financial wellbeing! Helen’s words bear repeating, nay trumpeting – loud and clear! “Employers often have really […]

Energy price rise warning piles even more pressure on struggling UK public

Energy bills will hit £4,266 for a typical household by January 2023 – piling even more pressure on the beleaguered UK public. That warning comes from consultancy firm Cornwall Insight. They say their higher estimate means that the average household are faced with paying a staggering £355 a month, instead of £164 a month currently. […]

Lifetime’s 2022 Employee Survey raises some important issues

An employer cannot truly support their employees if they don’t know what help they really need. It is so important to listen to your employees. You listen to understand. That’s where Lifetime’s financial wellbeing service can help. It can bring clarity, education, focus and awareness. Oh, and positive action! Lifetime’s employee survey is a tremendous tool that can […]

Biggest interest rate hike in 27 years as Bank of England warns of impending recession

After making the biggest hike to interest rates in 27 years, the Bank of England (BOE) has warned the UK is heading for a recession. Interest rates rose, for the sixth time in a row, to 1.75%, with inflation now set to hit over 13%. It is now being forecast that the UK economy will […]

Employees acknowledge need to start planning for retirement – Lifetime survey

There are thousands of employees across the UK who readily admit that they ‘really need to start planning for retirement’. Yet a lot of those workers don’t know how to begin that sort of in-depth planning – or who to turn to for help, guidance and advice. That’s why it is vital that employers play […]

Thousands of employees admit they ‘need to start planning for retirement’

There are thousands of employees across the UK who readily admit that they ‘really need to start planning for retirement’. Yet a lot of those workers don’t know how to begin that sort of in-depth planning – or who to turn to for help, guidance and advice. That’s why it is vital that employers play […]

Zooming in and out certainly gives a sense of perspective!

Before I became a financial planner with Lifetime, writes James Fisher, I spent a year training to become secondary school science teacher. While that turned out not to be the career for me, I certainly learnt a lot that I use to the current day. One of the things you soon find out as a […]

What Lifetime can bring

Lifetime’s digital service delivers an enhanced level of financial planning – allowing you to fully understand your finances and make informed money choices. As passionate providers of this innovative financial wellbeing programme we promise to: Listen to your concerns, hopes and ambitions Explain the financial facts using simple language, not jargon Show you how to […]

Cost of raising a child to the age of 18 is nearing £200,000 mark

The cost of raising a child to the age of 18 is heading towards the £200,000 mark. That’s according to the latest research from the Child Poverty Action Group. Since 2012 their annual cost of a child report looks at how much it costs families to provide a minimum socially acceptable standard of living for […]

‘More and more first time buyers are being gifted deposits from family’

More and more first time buyers are turning to the ‘Bank of Mum and Dad’ – or even the so-called ‘Family Bank’ – to obtain the deposits they need to get on the property ladder. That’s the view of Lifetime mortgage adviser Scott Kershaw (pictured). Scott says: “I’m finding that more and more first time […]

The desire to improve financial health is there but are employees being hampered by cost of living crisis?

Many people want to improve their financial health in 2022. A survey, carried out on behalf of abrdn investment company and taking in 2,000 UK adults, revealed that more than half (55%) were determined to get to grips with money matters so they would be in a better position. Yet those people – indeed, all of […]

Survey suggests millions expect to be still paying off their mortgage when they reach 65

Millions of people in the UK expect to be still paying off their mortgage when they reach the age of 65, according to new research. And some of those people will be dipping into their pension pots to do so. The survey, undertaken for the LV= and Wellbeing Monitor, took in 4,000 UK adults, and […]

Latest Google review talks of ‘total confidence that finances are in safe hands’

Here at Lifetime we strive to deliver the best service we can to every single one of our customers. We are passionate about helping them achieve financial health. That’s why we are delighted when we receive customer confirmation that what we set out to do is working…. Here is our latest Google review, kindly submitted […]

Award-winning Lifetime named Workplace Financial Wellbeing Champion

Lifetime has landed a top award for its innovative financial wellbeing service. The company has been named Workplace Financial Wellbeing Champion of the Year (UK) in the Worldwide Finance Awards 2022. The awards programme, run by Acquisition International, celebrates organisations who work tirelessly to make financial services a powerhouse industry that can bring positive benefits […]

Empowering employees to engage with their own financial journey

As specialist providers of workplace financial education and planning, Lifetime has spent years answering the most important questions that employees have, and is able to guide them all the way from hire to retire, with tailored support at each stage of their career. During the past couple of years we have revolutionised our financial wellbeing […]

Lifetime’s plan in place to reduce concern over cost of financial advice

There are still quite a number of people unwilling to seek financial advice because they deem it too expensive. That’s according to a new survey conducted for Hargreaves Lansdown by Opinium. The report showed that nearly three in 10 consumers (29%) admitted that they would avoid taking financial advice because, in their mind, it is […]

Lifetime mortgage adviser Scott can help you make sense of housing market

The average price of a UK home has topped £250,000 for the first time, but the housing market may be ‘starting to slow’. That’s according to property website Zoopla. The property organisation bases its monthly figures on a combination of sold prices, mortgage valuations and information and data on agreed sales. And it says that […]

Rapid rise in the number of employees reporting a lack of financial wellbeing support

There is a rapid rise in the number of employees reporting a lack of financial wellbeing support in the workplace. That’s according to the results of BrightPlan’s 2022 Wellness Barometer Survey. The survey suggests that since 2021 there has been a significant increase in employees reporting financial stress. Seventy-two per cent of those employees surveyed […]

Get a better picture of your financial health with the help of a Lifetime coach

Regardless of personal wealth, the question Lifetime’s coaches and financial specialists get asked most frequently by customers is some version of: “Will I be ok? Do I have enough?” It can cause all sorts of worry if you don’t know the answer! We want to help you get a better picture of your financial health […]

Lifetime-sponsored Barnsley Hospice golf day raises £7,000 for patient care

The Lifetime-sponsored Barnsley Hospice golf day proved to be another huge success. The event, again hosted by Silkstone Golf Club, managed to raise a tremendous £7,000 that will go to supporting patient care. Twenty-two teams took part and Barnsley FC legend Barry Murphy put in an appearance to support the day. ‘Kitch’s Klowns’ emerged triumphant […]

There needs to be real focus on the financial happiness of employees

Show your employees you’re serious about their financial future! Research undertaken by the CIPD over the last few years has shown that financial wellbeing is often overlooked by some organisations compared to physical and mental wellbeing. Yet money worries are a big cause of stress for employees. There needs to be real focus – and […]

Financial wellbeing in the workplace can no longer be a dream luxury

Employees might hold back from discussing their finances at work because they may be unsure if it would benefit them to do so. Lifetime believe that with the right financial wellbeing programme in place then employees will begin to see the benefits with far more clarity. They will understand that help is on hand and […]

Your financial health also affects your mental health

There’s an important theme running through this week. And we want to play our part in highlighting it! It is…..Mental Health Awareness Week! Your mental health is so, so important. It can affect how we feel, think and act. It can heavily influence our emotional, psychological and social wellbeing. At Lifetime we believe that your […]

Many UK adults are not planning for retirement or later life, new survey suggests

Three-quarters of UK adults have carried out little or no planning when it comes to the money they will need in later life and retirement. That’s according to a new report carried out by Standard Life. Their survey took in the thoughts and opinions of 5,000 18-91-year-olds in the UK. And 73% admitted that they […]

Helping your employees gain full control of their financial lives

There are plenty of reasons why financial wellbeing should be on any HR agenda. Employees with money worries are more likely to be distracted by those worries while at work. They may also have sleepless nights, leading to days when they simply can’t face work. Providing an independent means through which they can seek answers […]

A place to find the answers to your important financial questions

You’ve got a question. Perhaps more than one. They could well be one of these: When can I retire? How much life insurance and protection do I need? Where can I find a financial adviser? How much will I need when I retire? Can I afford to see a financial adviser? […]

Talking money matters with a professional could help ease your stress levels

Stress Awareness Month has been held every April since 1992. The purpose of having such a month is to raise awareness of the causes and possible cures for such a burden on our mental health. Now, let’s face it, it appears that stress is affecting more and more people. We’ve had to endure a couple […]

Excellent feedback from Lifetime pension webinar

“Thanks, lots to think about” “Thanks again…took away some good pointers” “Thank you, brilliant session!” “Please may I thank you for arranging this presentation. It was very well delivered and the team at Lifetime were very professional and knowledgeable” “Thought the info was good and ‘learning’” The above were just some of the comments we […]

It is no joke, employees need help now

Almost one in two UK adults (45%) don’t feel confident managing their money day to day. One in five people say their employer is not doing enough to support their financial wellbeing You may think that we are pulling your leg with these stats, considering it is April 1st, #aprilfoolsday! But sadly this is no April […]

The Chancellor giveth and the Chancellor taketh away…..

By Lifetime financial planner James Fisher Good news if you’re driving to a job with a median wage – less so if you’re receive a State Pension or other benefits. It’s been a strange couple of years since Rishi Sunak took up the role of Chancellor of the Exchequer. At first, many though he would […]

Is it time to speak to an adviser?

There doesn’t seem to be a lot of good news flying about these days. And if there is, it is being swamped by all the bad! It is so tough at the moment. Soaring energy bills The rising cost of food Fuel prices skyrocketing Inflation going up and up Russia’s invasion of Ukraine destabilising the […]

Five reasons why your employees’ financial wellbeing matters

Regardless of how the pandemic has affected your business, financial wellbeing and security has never been more important. Expectations have risen in so many areas of life. We demand flexibility, accessibility and knowledge on tap. Digital-first solutions – for home, health, work and leisure – are now the norm but not, until now, for financial […]

Financial wellbeing has to be integral to a company’s benefits programme; is it part of yours?

Soaring energy bills. The rising cost of food. Fuel prices skyrocketing. Russia’s invasion of Ukraine destabilising the world. Covid-19 still rearing its ugly head. All these things have intensified financial concerns. It appears to be getting harder and harder for people to make their money stretch far enough to meet their ‘needs’, let alone their […]

Protecting your most valuable assets cannot be wrong

A survey has shown that almost three-quarters of employees would would work harder for an employer that provided benefits that dealt with and supported their individual needs. The survey, carried out by MetLike UK, also found that two-thirds of employers are now reviewing the reward packages they offer their workforce. Employers and HR departments up […]

A financial education and wellbeing service is a vital step to understanding people’s needs

Employers are waking up to the fact that in this uncertain world they have to do all they can to care for their people. In more and more numbers they are embracing the need to support their staff’s financial wellbeing. Those bosses taking this step realise that financial education and guidance has to be embedded […]

Employees want to see their own wellbeing at the forefront of company policy

There is now greater emphasis than ever before on working flexibility, competitive compensation and wellbeing when it comes to an employer’s workforce. Caring companies are keen to look after their staff as much as possible. There is no doubt that the worldwide pandemic has accelerated the eagerness to adopt automation and digitalisation, as well as […]

A fresh new-look Lifetime website!

It was the right time! For a bit of a refresh! Lifetime has put time and resources into establishing an innovative, online financial wellbeing service that offers a pathway for people to take control of their finances and make better informed money choices. And our new-look website makes it clear, to both the employers we […]

What’s important to you?

What’s important in our lives? What do we want to be, have, or do in the future, for ourselves or our loved ones? Big questions! Those sorts of questions are also linked to our finances. You need to remember the answers you come up. Give yourself a constant reminder if necessary. For if you can […]

One size doesn’t fit all – not when it comes to your people!

Every employee is an individual in their own right – and has different needs. It is so important to keep that in mind when it comes to your staff’s financial wellbeing. One size doesn’t fit all. Not when it comes to your people! Everyone’s life and circumstances are different, so no two financial needs are […]

One in four employees say they lose sleep over financial concerns

Financial health affects mental health. Don’t you agree? One in four employees say they lose sleep about financial concerns and eight out of 10 take those worries into the workplace. Those are statistics we need to address! Employees with money worries are almost five times more likely to suffer from depression while four out of […]

Make it the Year of the Plan!

The first month of a new year is a great time to make new plans – and that includes your financial plan! You won’t be alone if you have made a few resolutions for the next 12 months or so. Lots of people will be in that frame of mind at this time of year. […]

Sixty is the most popular age to retire early – but do you know if you can actually achieve that aim?

Sixty is the most popular age to retire early. That’s according to research carried out by Aviva. One in four (25%) of workers surveyed said they intended to celebrate their 60th birthday by leaving the world of work behind. The biggest reason for heading into retirement at that particular time – given by 32% of […]

How would you define financial wellbeing?

Planning and preparing for our own personal financial journey can boost wellbeing. That’s what the research tells us. But just what does the term ‘financial wellbeing’ mean to you? Lifetime’s National Business Development Manager Andy Wealthall (pictured) was asked how he would define financial wellbeing: “If you take a look there are lots of descriptions […]

Do you actually know when you can afford to retire….?

In this day and age of pension freedoms, you can easily get confused by all the numerous options and avenues open to you regarding your retirement. Planning when to retire and how to pay for it can certainly be a daunting prospect. A large number of people expect to continue working – if they are […]

Feel the benefits of Lifetime’s Digital Service

People often seek financial advice because of a specific concern, such as doubts over a pension policy, but right at the heart of that need is one overriding thing: peace of mind. You want to make sure that you can live how you want without ever running out of money. That’s an important goal and […]

Asking for help over money matters may lead to a stress-free future

Worrying about money is not limited to those with debt. People worry about saving for a home, the cost of raising a family, funding relatives in care, where to invest their savings, losing their job….just getting to the next payday…the list goes on. Your money is an important subject. It can play a key part […]

Let’s make people feel comfortable and confident when talking about their money

Making people feel comfortable enough to talk. It’s difficult. Especially when the subject matter is deeply personal. Over the last few years there has been huge progress when it comes to addressing the stigma associated with mental health. That progress has been notable within the workplace. According to the Employer’s Guide to Financial Wellbeing 2020-21 (from […]

Majority of people are happy to continue with new way of interacting with their planners

Covid-19 has impacted so many lives, on different levels, for different reasons. People have certainly changed the way they now interact with financial experts. The statistics that have emerged from a new survey carried out on behalf of investment company Abrdn show that more and more people have embraced technology and are now more confident […]

Providing access to guidance, education and someone to talk to is one of the first steps to helping your people

In a poll by YouGov, more than a third of employed people admitted to missing out on a ‘good night’s sleep’ because of their money worries. That’s a statistic that Lifetime is working hard to change. We partner with employers to deliver help and guidance to employees when it comes to financial matters. The way […]

Can’t see the wood for the trees? Let’s help…..

What’s that old saying…….’you can’t see the wood for the trees’. What does it really mean? Well, the main definition is that if someone can’t see the wood for the trees, ‘they are so involved in the details of something that they do not notice what is important about the thing as a whole’. That could […]

Every generation of worker can benefit from a wellbeing service that offers financial planning

Employers want staff who are fully committed, engaged and productive in their work (certainly during their working hours). That’s totally understandable. But that equilibrium can be undermined if employees have money worries and fears that affect their mindset and wellbeing. Your workforce need to be happy and confident if they are to be committed and […]

Of the many things that can damage your mental health, money is one of the biggest

The World Health Organisation recognises World Mental Health Day on October 10th each year. The official theme for 2021 is ‘Mental Health in an Unequal World’. Mental health problems can affect anyone, at any moment. It is a vital issue ‘at the best of times’, but the need for support, guidance, help and advice has […]

Saving – and all it entails!

People often find it difficult to know where to start saving, how much you need to put away, and what that money will amount to in the future. The first thing you need to do is think about how long you want to save for. Is it for two to five years, perhaps for a […]

Financial wellbeing in the workplace can be achieved for the benefit of both employer and employee

When employees can’t focus on work due to the financial strain and worry they are under, it is not only they who suffer. Employers pay the price too, particularly when it comes to their workforce’s wellbeing. If that wellbeing is low, or, God forbid, non-existent, then motivation, concentration and productivity drop. Yet companies don’t have […]

A pension can play such an important role in someone’s life

This week is #PensionAwarenessWeek. Here at Lifetime we heartily agree it is a subject that needs raising awareness of! Pensions can be a complex subject and we understand the importance a pension can play in someone’s life. Do you know what sort of pension you have? Do you know where your pension is situated? Do […]

Taking control of your retirement planning

Taking control of your retirement. It’s by no means an easy thing to do, is it? In this day and age of pension freedoms, you can easily get confused by all the numerous options and avenues open to you regarding your retirement. And planning when to retire and how to pay for it can certainly […]

‘Just utterly brilliant’ – happy client hails Lifetime mortgage service

Our latest Google review centres on our mortgage service. Lifetime client Toby Foulds was delighted with the help and guidance he received from our mortgage adviser Scott Kershaw CeMAP. Toby wrote: “It’s taken me a while to get round to leaving this glowing review but that’s only because I’m too busy redecorating the house that […]

When free means free!

There’s not many people who talk freely about money. Yet here at Lifetime we make a habit of it! We believe that money, and what we do with it, is an important subject. One starting point is how much you have to pay out. Or not, as the case might be! Take Lifetime’s digital service. […]

‘You provide an excellent service that is understandable and honest’

Lifetime regularly ask the people we help (through the company’s client questionnaire) if our service has been of value. One female client, Deborah Black, kindly returned her form and her kind words (about Lifetime and in particular her adviser Paul Lee) reinforced our belief that ‘we are on the right track’ and our financial planning […]

Making people feel comfortable enough to talk about their finances

Making people feel comfortable enough to talk. It’s difficult. Especially when the subject matter is deeply personal. Over the last few years there has been huge progress when it comes to addressing the stigma associated with mental health. That progress has been notable within the workplace. According to the Employer’s Guide to Financial Wellbeing 2020-21 […]

My Lifetime financial planner offers invaluable help and advice when I most need it

Feedback is extremely welcome. Very useful too. Genuine feedback from customers or clients, whether good, bad, positive or negative, is always helpful. It is important information that can be used to make important decisions. The very best companies are where they are because they constantly search for ways to make their very best even better! […]

Mortgage help leads to glowing Google review

We are always grateful when someone engages with us and afterwards decides to leave a #googlereview. Our latest centres on the mortgage help we offer. It reads: “Lifetime Mortgage Adviser Ken Abbott has recently helped me with my second mortgage. Being self employed, getting a mortgage is never going to be straight forward but Ken has […]

The time has come to make financial wellbeing work for everyone

There is no doubt that financial wellbeing is a benefit for employee and employer alike. That’s why we need to push it to the forefront of the conversation. Right now, as the government takes steps to lift the majority of Covid-19 restrictions, such financial insight, guidance and advice has never been more important. While some […]

The power of stability

Should employers be focused on helping their employees when it comes to stability? It’s a worthwhile question don’t you think? Stability is crucial when it concerns the workplace. It goes a long way to helping people do their best work. It brings peace of mind, it can boost confidence, it can propel productivity. Now some […]

Generation Xers, the time to act is now as new research suggests bleak retirement beckons

A bleak retirement beckons for many middle aged people, new research suggests. The research, carried out by the International Longevity Centre (ILC) on behalf of Standard Life, revealed that nearly one in three people aged between 40 and 55 are not saving nearly enough for the day when they finish work and begin their retirement […]

If you are asking Google ‘are pensions worth it?’ Here is Lifetime’s answer!

The FTAdviser published a story this week saying that many Britons seeking help with their finances have asked Google ‘Are pensions worth it?’ (https://lnkd.in/dvGNugb). This is Lifetime’s answer to the ‘Are pensions worth it?’ question (it makes up part of the FAQs section on our website, https://www.lifetime-fm.com/faqs/ In short – yes! One of the main benefits […]

Let us share true stories of life insurance benefits

A lot has been made over the past few days on the topic of life insurance. Putting protection policies in place for people has come in for criticism in certain quarters. Here at Lifetime we put our clients’ financial situation and financial wellbeing first and foremost. And, as financial planners, if we believe our clients […]

A stroke of luck it most certainly wasn’t, but there’s light at the end of the tunnel….

A stroke of luck it most certainly wasn’t… In fact, was a stroke of a much more debilitating nature. It came this morning, F.A.S.T – just as the tv advert warns it can. I had been fine up until that moment. Well, blood pressure was too high, but that’s a given, right? I was a […]

Employers: what is the impact of staff struggling to achieve their dream of purchasing their first home?

House asking prices have hit record levels across every part of the UK. That’s according to the June 2021 statistics released by property listings website Rightmove. The average price of properties now on the market rose by 0.8% to a third consecutive monthly record of £336,073, says Rightmove. The new record figure appears to be another […]

‘Too expensive’; ‘Getting advice is only for the wealthy’; Royal London research again reveals the need to debunk money myths

‘Getting financial advice is too expensive’. That’s the main reason why people don’t seek help and advice on their finances, according to recent research. The mutual life, pensions and investment company Royal London interviewed around 4,000 people and the research revealed a number of reasons why people do not engage with financial advisers. The biggest […]

From an employee’s point of view, a pay rise remains one of the clearest forms of measurement and ‘doing well’. But is it ‘the be all and end all?’

Imagine a caring employer. Keen to help and ensure staff enjoy emotional and financial wellbeing – so that they are happy in work and just as importantly out of it. The employer decides to implement a positive financial wellbeing benefits policy, and has stumped up the resources and money to make sure the service is […]

Client so grateful for help, guidance and kindness from financial planner Paul – and for Lifetime’s ‘wonderful service’

There are times when a financial adviser or financial planner can be so much more than just a professional person imparting their knowledge and expertise. Sometimes it goes beyond just merely giving that important advice on someone’s financial affairs – and can veer into territory where showing kindness, empathy, consideration and understanding can have such […]

‘Times have changed in our profession’ says Lifetime MD

The way financial advice is delivered has changed massively over the years. Certainly, over the last 12 months or more, financial advisers and planners have had to find new ways to support and help their clients. Here Lifetime MD Ian Dickinson (pictured) talks about the changes in our profession: “In the late 1980s and through […]

Lifetime clients delighted with digital service

Having people truly value what you do – and why you do it. They are things that businesses constantly strive for. At Lifetime we put our clients at the very centre of what we do. Helping them achieve what they want from their lives, via a flexible financial life plan, is something we are passionate […]

Lifetime delighted to promote financial wellbeing with conference sponsorship

Lifetime are committed to helping employers help their employees understand their financial choices, take control of their lives and make good decisions surrounding their money. That’s why we are delighted to be one of the sponsors of the 2021 Rewards and Benefits Conference which takes place tomorrow (Wednesday, May 12th). Many businesses have already realised […]

Lifetime-sponsored Barnsley Hospice golf day is a sell-out

The countdown to the 2021 Lifetime-sponsored Barnsley Hospice Golf Day is now well and truly on. The popular charity event, which is again being held at Silkstone Golf Club on Friday, May 14th, is a sell-out. As well as again being the main sponsor, Lifetime has also put forward a team, which will be led […]

Connect with your finances too!

Almost 8 in 10 UK employees take their money worries to work, affecting their performance.* And as well as affecting work performance, it must surely hit hard on an employee’s mental health and emotional wellbeing too. Today is the start of #mentalhealthawarenessweek2021. The theme this year is ‘Connect with nature’ (https://www.youtube.com/watch?v=TdDioDtjkis). Here at Lifetime we believe […]

We will help you get the answers to some very important questions

You’ve got a question. Perhaps more than one, a whole shedload! They could well be one of these: When can I retire? How much life insurance and protection do I need? Where can I find a financial adviser? How much will I need when I retire? Can I afford to see […]

Remember, when it comes to financial planning, you are unique!

When it comes to financial planning there is something very important to remember. You are unique. You are different from everyone else out there. Your situation is different from that of your boss, your work colleagues, your next door neighbour, your close friends. So when it comes to looking at establishing your own financial plan, […]

Two thirds of people retiring this year risk running out of money, new survey suggests

Two thirds of this year’s retirees risk running out of money in the future. That’s according to a new study carried out for Standard Life Aberdeen. The research, undertaken by Censuswide in February, covered 2,000 UK adults who were either due to retire sometime in the next 12 months, or had retired in the past […]

A team that can help you land that mortgage

Here at Lifetime we have a dedicated Mortgage department who source and recommend the mortgage lenders that deal with intermediaries. Whether you’re buying your first home or moving up the housing ladder the time when you need a mortgage can be exciting. However, choosing the mortgage for you can be daunting. Our experienced mortgage team […]

When the human touch can prove the difference in financial planning

The rise of robo-advice in financial services over the last decade has understandably coincided with the unceasing march of technology. There is no doubt that technology continues to transform every facet of our lives – and the financial sector is no different. Nowadays, if you so wish, you can become an investor with just a […]

Truth has the power to shock – but can lead to enlightenment and happiness!

The quote above, credited to celebrated late-nineteenth-century French author Jules Renard, is an apt one when it comes to telling this tale. For truth indeed had the power to shock for two of Lifetime’s clients. Fortunately for them, that shock led to immediate change – and with that change came clarity, enlightenment and happiness. […]

Everyone’s financial situation is different – that’s why you need a service like this!

Lifetime help people understand what their money can and cannot do for them. We have vast experience in delivering innovative financial planning – life planning – to thousands of individuals, couples and families across the UK. We also partner with employers to bring financial understanding, clarity and wellbeing to their employees. This is done via […]

Survey shows that pension and retirement, as well as savings, are what employees would like to ask about most

Lifetime recently conducted a survey amongst nearly 350 employees of an education provider and client in the North of England. One of the questions posed to the employees was: ‘If you could ask a financial expert anything what would it be?’ There were two subjects that came out easily the most popular. The first one […]

When it comes to his finance story, the Bard of Barnsley is happy to let Lifetime do the talking for him!

Ian McMillan is an acclaimed English poet, writer, playwright, and broadcaster. He is well known for his strong and distinctive Yorkshire accent on such programmes as BBC Radio 3’s The Verb. He continues to live in Darfield, the village of his birth, and is a fervent, season-ticket holding fan of his hometown football club, Barnsley […]

Spring clean your ‘too hard to do box’

Do you have a ‘too hard to do box’? Is it full of important papers and documents that you can’t bear to look at, or simply don’t want to? The ‘too hard to do box’ might actually be in the form of a biscuit tin, a ring binder, or even a messy drawer. Whatever it […]

‘Steve always explains things well and puts us at ease’

Our pension specialist Steve Lambarth (pictured) has received lovely feedback from Lifetime client Nick Boothroyd, who responded to the following questions: How was the interaction with your financial planner? Did they put you at ease and explain things in a way that resulted in understanding and reassurance? “Yes, absolutely. Steve always explains things well and […]

Hands up if you are the person with a ‘too difficult to deal with’ carrier bag, biscuit tin or shoe box!

Hands up if you are the person with a ‘too difficult to deal with’ carrier bag, biscuit tin or shoe box – which contains all the information you have about your money. There are thousands, perhaps millions of you out there, all putting the latest pension or mortgage statement into that ‘difficult’ box without having […]

Five-star feedback for Lifetime financial planner Robert reinforces ‘why we do what we do’…..

There are times when a financial adviser or financial planner can be so much more than just a professional person imparting their knowledge, and giving advice. They can also be a trusted human being to turn to in a time of need. Lifetime financial planner Robert Bligh (pictured below) was the ‘trusted human being’ who […]

MD Ian Dickinson is Lifetime video star!

Managing Director Ian Dickinson was the ‘video star’ in the latest of Lifetime’s filming projects. Ian proved a bit of a natural in front of the camera as he talked freely about himself, and the company he started two decades ago. What clearly comes through is Ian’s continued passion for helping people via Lifetime’s financial […]

Young adults potentially face 12 years shortfall when it comes to retirement cash according to survey

Research carried out by Aegon has suggested that young adults face a significant financial shortfall by the time they come to retirement. The survey also revealed that only 20% of young adults feel they are on course to achieve the income they need in retirement. The Aegon Retirement Readiness Survey 2020: Young adults reinventing life, work, […]

Lifetime link-up with Academy Trust receiving attention

Lifetime’s link-up with Hoyland Common Academy Trust is receiving attention in the financial press. The online publication ftadviser.com has reported on the partnership, which sees Lifetime provide financial education and guidance to HCAT employees. So too has Best Advice, with a story written by Kevin Rose. Financial management company Lifetime, through the launch of its […]

Helping people secure their mortgage brings great job satisfaction

Helping people land a mortgage brings a real buzz to the Lifetime team. That’s according to our Mortgage department manager Michelle Youel. Despite the COVID-19 pandemic playing havoc with the lives of so many people, Michelle (pictured) says that over the last 12 months she and the dedicated Lifetime mortgage team have still managed to […]

Free financial video shows Lifetime customer is on the right path

We passionately believe that financial guidance has never been as important as it is right now. That is why the Lifetime digital service was launched, to help people take control of their future, and make informed decisions that could boost their emotional and financial wellbeing. That help and guidance proved decisive for one lady who […]

Sign up for our free webinar: ‘Five surprising ways to take back control of 2021’

Financial wellbeing is a topic close to our heart and for many people it has already been a tough start to the year. So, with this in mind, our next webinar (27th January) will focus on ‘Five surprising ways to take back control of 2021’. In this webinar we will be revealing our top five […]

The two Steves helping Lifetime clients feel confident!

One of Lifetime’s core values is ‘Ownership’. For us that means that: We consider the impact on our colleagues and clients in every decision we make. We care about our business and take pride in delivering great service and quality for our customers. We are passionate and take responsibility to: “think bigger than ourselves”. We […]

Brian’s expert guidance and advice appreciated by new Lifetime clients

Financial planner Bran Howard (pictured) has been helping some new Lifetime clients deal with their financial affairs. Brian takes up the story: “Unfortunately, a close relative (and a Lifetime client) had passed away unexpectedly, but had left them with a sizeable sum of money and property. “The initial Lifetime client’s Transact pension has been transferred […]

Lifetime adviser Brian on helping widow deal with late husband’s finances

A financial adviser can be so much more than just a professional person giving advice. They can be also be someone to turn to in a time of need. Lifetime financial planner Brian Howard (pictured) was just such a person for one particular client. Brian explains: “I looked after the husband and wife, but unfortunately […]