As at November 27, 2015:

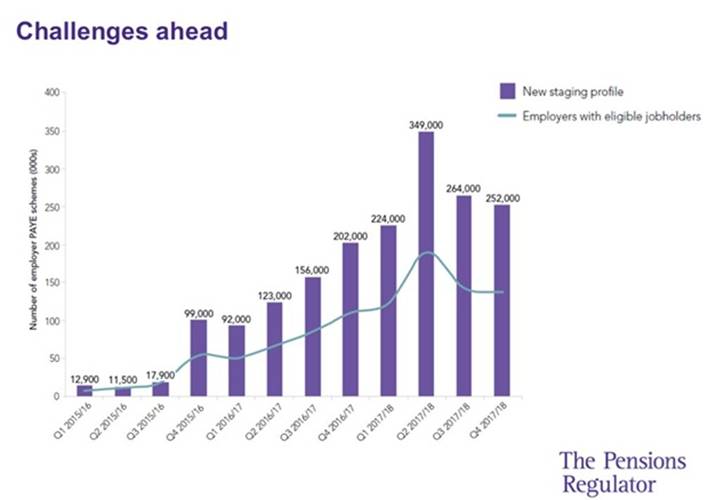

The latest figures on employers who are due for their Auto Enrolment staging next year and beyond continue to highlight the need for making preparations well in advance.

Deciding on who and how the ongoing assessments will be run is the first challenge. After that it is finding the right scheme.

Just finding the right pension scheme and then leaving it until the last minute to commence set up is almost certainly not an option for employers.

The need to have at least completed some sort of initial set-up with payroll and a pension scheme provider is a must, if employers wish to avoid being left behind, or left with a scheme of last resort.

The Pensions Regulator says that compliance with Automatic Enrolment continues to be the norm.

The Regulator adds: “Since the start of Automatic Enrolment in 2012, over 60,000 employers have put more than 5 million members of staff into a workplace pension, with only a small minority failing to comply with their duties on time.

“The majority of this non-compliance has been unintentional and we have worked with these employers to put matters right at the earliest opportunity.

“It is encouraging that according to our latest employer survey, the majority of small and micro employers due to stage this year are well underway with their preparations. The research highlighted that nine in 10 employers staging between August and November 2015 had begun to prepare, and that awareness of Automatic Enrolment had increased among micro employers, while understanding levels increased significantly amongst both small and micro employers.

“In the next 12 months over 500,000 employers will go through Automatic Enrolment. We expect to see a rise in the number of times we need to use our powers, so our message to employers remains clear: start getting your plans in place early or you risk being fined.”

- To learn more about how to manage Auto Enrolment, contact the Pensions Department at Lifetime and speak with one of our Auto Enrolment Specialists. Telephone: 01226 208 600.